Multinational Monitor |

||

|

NOV 2004 FEATURES: The Political Economy of Immigration Reform: The Corporate Campaign for a U.S. Guest Worker Program Freeloaders: Declining Corporate Tax Payments in the Bush Years Advice and No Dissent: Public Health and the Rigged U.S. Trade Advisory System The Ultimate Dumping Ground: Big Utilities Look to Native Lands to House Nuclear Waste INTERVIEW: Chemical Trespass: The Verdict on Dow DEPARTMENTS: Editorial The Front |

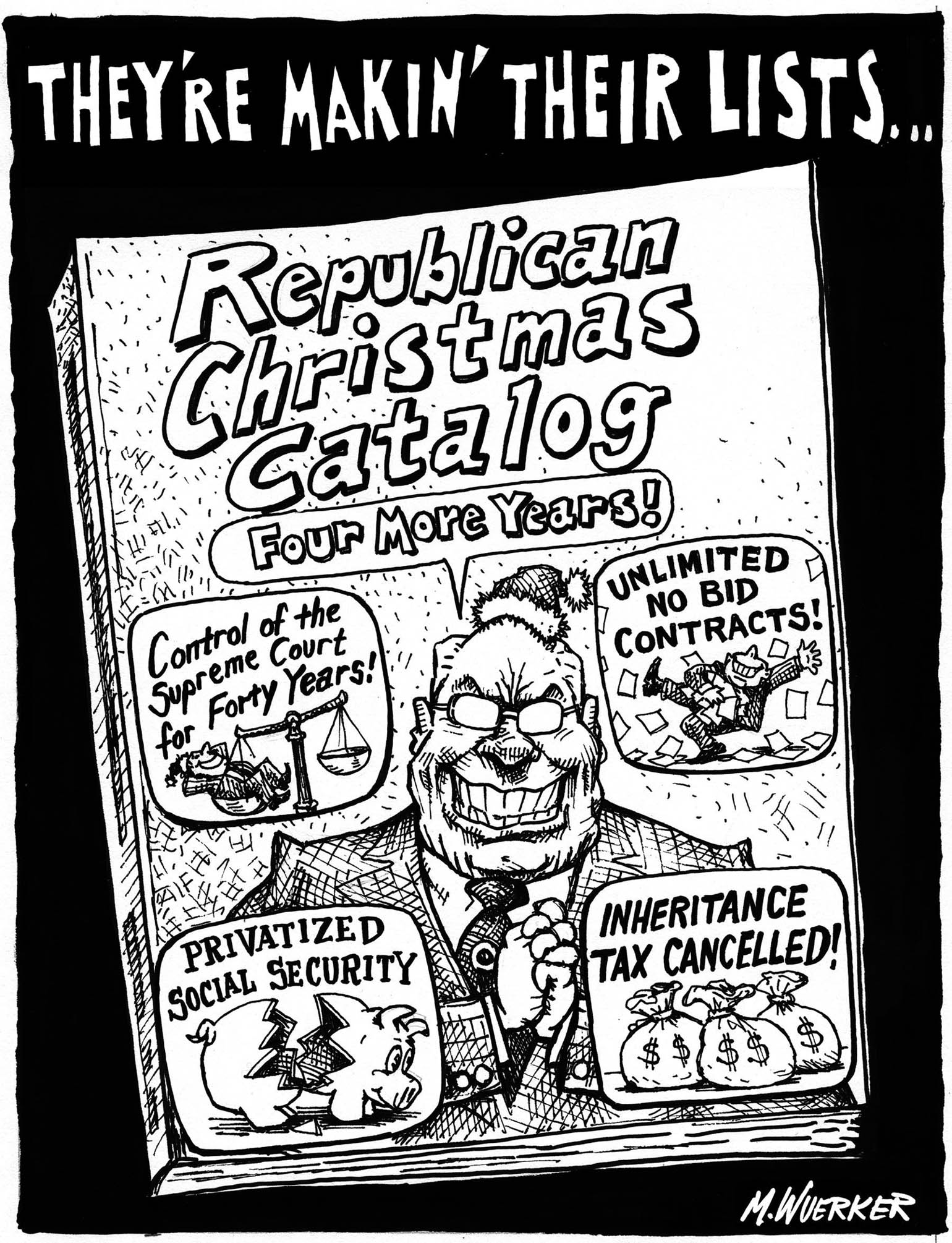

The Nightmare Continues

Freeloaders: Declining Corporate Tax Payments In the Bush YearsBy Robert McIntyre and T.D. Coo Nguyen Ostensibly, the U.S. federal tax code requires corporations to pay 35 percent of their profits in income taxes. But of the 275 Fortune 500 companies that made a profit each year from 2001 to 2003 and for which adequate information to draw conclusions is publicly available, only a small proportion paid federal income taxes anywhere near that statutory 35 percent tax rate. The vast majority paid considerably less. In fact, in 2002 and 2003, the average effective tax rate for all of these 275 companies was less than half the statutory 35 percent rate. Over the 2001-2003 period, effective tax rates ranged from a low of –59.6 percent for Pepco Holdings to a high of 34.5 percent for CVS. Over the three-year period, the average effective rate for all 275 companies dropped by a fifth, from 21.4 percent in 2001 to 17.2 percent in 2002-2003. The statistics are startling. MORE>> Advice and No Dissent: Public Health and the Rigged U.S. Trade Advisory SystemBy Joseph Brenner and Ellan Shaffer The United States has signed and is currently negotiating a striking array of trade agreements with countries around the world. Critics charged that these trade deals reflect undue business influence over the U.S. trade negotiating process. It turns out that industry influence is structured into the very machinery of the U.S. governmental trade bureaucracy. In 1974, Congress created an international trade advisory system as a mechanism for input into trade negotiations from interested parties in the United States. An extensive group of advisory committees now provide formal recommendations to the official U. S. trade negotiating agency, the Office of the U.S. Trade Representative (USTR). Business and trade association representatives dominate those committees. But international trade agreements do not just affect narrow commercial interests. There is growing recognition that these trade deals can significantly shape public health-related policies both in the United States and in other countries, by requiring changes in laws and regulations and especially by foreclosing policy options that countries may wish to pursue in the future. MORE>> Chemical Trespass: The Verdict on DowAn interview with Jack Doyle Jack Doyle is director of J.D. Associates, a Washington, D.C.-based investigative research firm specializing in business and environmental issues, and author of Trespass Against Us: Dow Chemical and the Toxic Century (Common Courage Press, 2004). Doyle has been writing about technology, business and the environment for more than 20 years. He is the author Riding the Dragon: Royal Dutch Shell and the Fossil Fire (www.shellfacts.com, 2002), Taken for a Ride: Detroit’s Big Three and the Politics of Pollution (Four Walls Eight Windows, 2000), and Crude Awakening: The Oil Mess in America: Wasting Energy, Jobs and the Environment (Friends of the Earth, 1994). He has consulted with various public agencies, including the President’s Council on Environmental Quality and the former Congressional Office of Technology Assessment. MORE>>

|

|