|

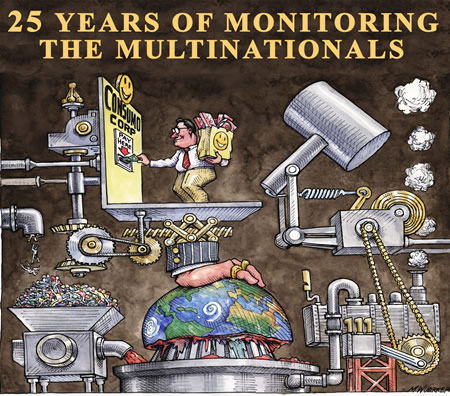

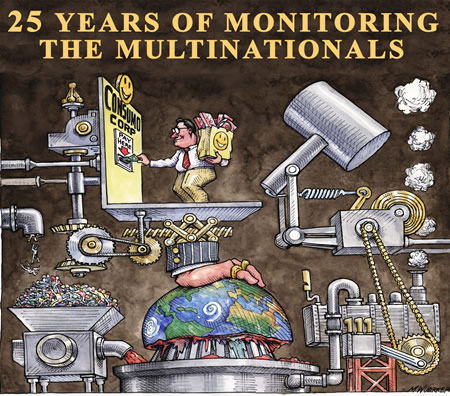

JAN/FEB 2005

VOL 26 No. 1

FEATURES:

Don't Mourn, Organize: Big Business Follows Joe Hill's Entreaty to U.S. Political Dominance

by Robert Weissman

Wall Street Ascendant

by Doug Henwood

Slow Motion Coup d'Etat: Global Trade Agreements and the Displacement of Democracy

by Lori Wallach

Every Nook and Cranny: The Dangerous Spread of Commercialized Culture

by Gary Ruskin and Juliet Schor

Profits of War: The Fruits of the Permanent Military-Industrial Complex

by William Hartung

Wal-Mart: Rise of the Goliath

by Liza Featherstone

Monster Banks: The Political and Economic Costs of Banking and Financial Consolidation

by Jake Lewis

Grand Theft: The Conglomeratization of the Media and the Degradation of Culture

by Ben Bagdikian

INTERVIEW:

Do We Not Bleed? Flower Workers and the Struggle for Justice

an interview with Olga Tutillo and Ricardo Zamudio

DEPARTMENTS:

Letters to the Editor

Behind the Lines

Editorial

Reflections on 25 Years

The Front

Philippines to be Drilled - Nuke Power Deal Put to Rest

The Lawrence Summers Memorial Award

Names In the News

Resources |

Don't Mourn, Organize: Big Business Follows Joe Hill's Entreaty to U.S. Political Dominance Don't Mourn, Organize: Big Business Follows Joe Hill's Entreaty to U.S. Political Dominance

by Robert Weissman

For more than two decades, a corporate political juggernaut has rolled over citizen interests the world over. It was not always so.

In the 1960s and 1970s, it was Big Business that was on the defensive. In the United States, a low-unemployment economy increased workers’ bargaining and, indirectly, political power. The modern environmental movement formed and quickly began transforming popular consciousness and scoring important political victories. Following Ralph Nader’s breakthrough with Unsafe At Any Speed, the consumer movement began uncovering case after case of corporate abuse and successfully pushing for reform. The anti-war, civil rights and women’s movements all mounted broad social challenges intended to democratize the economy...

In leading business circles, these developments were viewed with alarm. In 1971, Lewis Powell, a prominent corporate lawyer who would soon be appointed to the U.S. Supreme Court, prepared a memorandum, “Attack on American Free Enterprise System,” for the U.S. Chamber of Commerce. This widely circulated memo asserted that “no thoughtful person can question that the American economic system is under broad attack.” More>>

Slow Motion Coup d'Etat: Global Trade Agreements and the Displacement of Democracy

by Lori Wallach

In the 1980s, the same ideological and business interests behind the Thatcher and Reagan “revolutions” opened a second front in their campaign to create a world in which the role of government would be shrunk and the fulfillment of basic human rights and needs would be left to the mercies of markets and corporations.

Their strategy was to transform the 1947 General Agreement on Tariffs and Trade (GATT) into a powerful new system of global governance that would fence in the permissible scope of accountable democratic governance. This new system of global governance was envisioned to be an instrument to implement one-size-fits-all, within scores of countries, the policies that would enable corporate rule to thrive. More>>

Profits of War: The Fruits of the Permanent Military-Industrial Complex

by William Hartung

U.S. weapons contractors have had their ups and downs over the past 25 years, but they have done far better than they should have. They have cashed in by pursuing a few simple strategies: 1) exaggerating the threats faced by the United States; 2) marketing their weapons systems as the answer to national security problems, regardless of their actual relevance to the needs of the moment; and 3) exploiting well-cultivated relationships with Pentagon officials, members of Congress, White House decision makers and opinion shapers in the media and think tanks. More>>

Monster Banks: The Political and Economic Costs of Banking and Financial Consolidation

by Jake Lewis

Commercial banks in the United States have been on a wild ride over the last 25 years. They have seen record profits, vastly expanded powers and a new post-Depression record for bank failures. Today the industry is still in the midst of a massive concentration of financial resources.

As President Reagan’s first term came to a end in 1984, there were 15,084 commercial banks and thrift institutions in the 50 states. By the end of 2003, the number had dropped to 7,842 — almost a 50 percent reduction. The majority of the decline from 1984 to 2003 was among banks of $1 billion or less in assets, many them swallowed up in mergers and acquisitions by the mega institutions. More>>

|

Mailing List Search

Editor's Blog

Archived Issues

Subscribe Online

Donate Online

Links

Send Letter to the Editor

Writers' Guidelines

HOME |

Don't Mourn, Organize: Big Business Follows Joe Hill's Entreaty to U.S. Political Dominance

Don't Mourn, Organize: Big Business Follows Joe Hill's Entreaty to U.S. Political Dominance