Multinational Monitor |

||

|

NOV/DEC 2005 FEATURES: The Ten Worst Corporations of 2005 Taking On Corporate Power - and Winning by Robert Weissman INTERVIEW: Corporate Crime and Prosecution DEPARTMENTS: Editorial The Front |

The Ten Worst Corporations of 2005

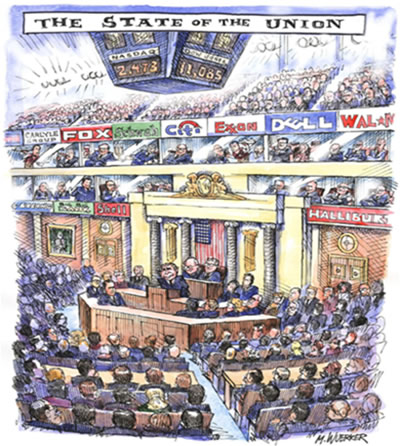

by Russell Mokhiber and Robert Weissman 2005 was a good year for bad corporations. There were no U.S. elections to worry about, with their troubling possibility of politicians running on the popular platform of curbing corporate power. There were corporate scandals and corporate crime and violence galore, but none that rated the ongoing banner headlines of Enron and WorldCom. Indeed, the ongoing prosecutions of individuals associated with corporate financial scandals enabled Big Business and its apologists to claim there had actually been a crackdown on corporate crime. All leaving corporations free to buy legislation, profiteer, pollute, poison and mistreat workers without restraint. Benefiting from the spike in oil prices associated with the tragedy of Hurricanes Katrina and Rita, ExxonMobil recorded the most profitable year any company has ever achieved. Thirty years ago, when the oil giants profiteered in the wake of the first oil embargo, almost half the U.S. Senate voted to break up the integrated oil companies. In 2005, just 40 of 435 members of the House of Representatives were willing to co-sponsor the leading legislation calling for a much more modest approach, imposing a windfall profits tax on the oil companies. Eight members of the Senate co-sponsored the leading windfall profits bill there. MORE>> Corporate Crime and ProsecutionAn Interview with Win Swenson Win Swenson can legitimately be called the father of the U.S. corporate sentencing guidelines. He was general counsel at the U.S. Sentencing Commission during the early 1990s and was instrumental in the development of the guidelines to help judges determine sentences for corporate criminals. The sentencing guidelines were later used as a model for the Holder and Thompson memos — U.S. Justice Department memos that give guidance to federal prosecutors on whether to charge a corporation with a crime. In 1996, he went to work for the accounting/consulting firm KPMG, to head up its national compliance and ethics consulting practice. He left in 2000 and became a partner in Compliance Systems Legal Group, a law firm which focuses exclusively on providing legal advice on compliance and ethics programs. MORE>>

|

|